This guide reveals billionaire strategies for building generational wealth, emphasizing financial education, risk reduction, and smart investments․ Available as a free PDF, it offers practical steps for everyday investors to adopt these proven methods, ensuring financial security and growth for future generations while avoiding common pitfalls like stock market speculation․

Overview of the Guide

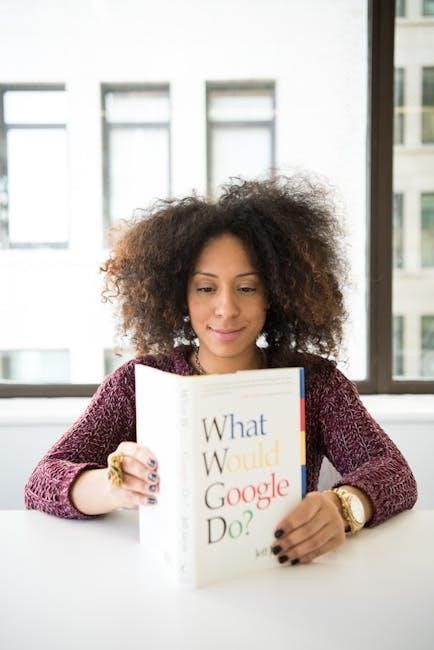

The guide, “What Would Billionaires Do?” provides a comprehensive roadmap for building and preserving generational wealth․ It outlines strategies inspired by billionaire practices, focusing on financial education, risk reduction, and tax optimization․ The guide emphasizes creating a family bank to empower future generations and offers practical steps for implementing these strategies․ It also highlights the importance of avoiding stock market speculation and instead investing in stable, high-yield assets․ Available as a free PDF download, the guide is accessible to anyone seeking to adopt billionaire-like financial habits․ It serves as a valuable resource for individuals aiming to secure their financial future and leave a lasting legacy․ The content is designed to be actionable, ensuring readers can apply the principles immediately․ By following the guide, everyday investors can achieve financial freedom and build wealth that endures for generations․

Importance of Financial Education

Financial education is the cornerstone of building generational wealth, as emphasized in “What Would Billionaires Do?” This guide underscores the necessity of understanding key financial principles to make informed decisions․ By learning how to minimize risk, optimize taxation, and invest wisely, individuals can secure their financial future․ The guide highlights that financial literacy empowers families to avoid costly mistakes and create sustainable wealth․ It encourages readers to adopt a long-term perspective, focusing on asset diversification and strategic planning․ Available as a free PDF, the guide democratizes access to knowledge traditionally reserved for the wealthy, enabling anyone to implement billionaire-inspired strategies․ This education is not just about accumulating wealth but also about preserving it for future generations, ensuring a lasting legacy of financial stability and prosperity․ Educating oneself financially is the first step toward achieving economic freedom and security․

Strategies for Building Generational Wealth

Creating a family bank, minimizing risk and taxation, and strategically passing wealth to future generations are key strategies outlined in the guide, available as a free PDF download․

Creating a Family Bank

A family bank is a powerful strategy for building generational wealth, enabling the efficient transfer of assets and minimizing taxes․ It allows families to protect and grow their wealth while ensuring future generations benefit․ By centralizing financial management, it fosters collaboration and long-term planning․ The guide highlights how this structure can be implemented to safeguard family legacy and create a lasting financial foundation․ Available as a free PDF download, it provides step-by-step guidance on establishing and maintaining a family bank, ensuring wealth preservation and abundance for years to come․

Minimizing Risk and Taxation

The guide outlines strategies to reduce financial risks and optimize tax efficiency, crucial for preserving and growing wealth․ By avoiding speculative investments and leveraging tax-advantaged structures, individuals can safeguard their assets․ Techniques such as estate planning and wealth transfer methods are detailed, ensuring minimal tax burdens․ These approaches enable families to retain more of their wealth, passing it securely to future generations․ The free PDF download provides actionable insights, helping readers implement these strategies effectively to protect their legacy and maintain financial stability․ This section emphasizes the importance of proactive planning to mitigate risks and reduce taxation, aligning with billionaire methodologies for sustained prosperity․

Passing Wealth to Future Generations

Passing wealth to future generations is a cornerstone of billionaire strategies, emphasizing long-term legacy and financial security․ The guide highlights methods such as creating a family bank and implementing trusts to ensure assets are protected and efficiently transferred․ Tax-efficient planning is central, allowing families to retain more wealth while minimizing legal and financial burdens․ By establishing clear structures, individuals can guarantee that their heirs inherit not only wealth but also the knowledge to manage it wisely․ The free PDF download provides detailed insights into these strategies, helping readers create a lasting legacy․ This approach ensures that wealth endures for generations, aligning with the principles of billionaires who prioritize sustainable prosperity for their families․

Investment Strategies of Billionaires

Billionaires focus on diversification, alternative investments, and tax-efficient strategies to grow and protect wealth․ The free guide highlights real estate, asset diversification, and avoiding risky stock market speculation to ensure generational prosperity․

Alternative Investments

Billionaires often diversify their portfolios through alternative investments, such as private equity, real estate, and rare assets, to minimize risk and maximize returns․ These strategies, detailed in the free guide, are designed to protect wealth from market volatility and inflation․ By allocating funds to non-traditional assets, investors can achieve steady growth while avoiding the unpredictability of stock markets․ This approach, emphasized by wealth-building experts, allows individuals to create a balanced portfolio that aligns with their long-term financial goals․ The guide provides insights into how to identify and capitalize on these opportunities, ensuring a secure and prosperous financial future․

Real Estate and Asset Diversification

Real estate is a cornerstone of billionaire wealth-building strategies, offering stability and significant returns․ The free guide highlights how investing in property diversifies assets, reduces risk, and generates passive income․ By leveraging real estate, individuals can build a solid financial foundation, similar to how billionaires like the Rockefellers have secured their legacies․ The guide also emphasizes the importance of diversifying across different asset classes to protect against market fluctuations and economic downturns․ This balanced approach ensures sustained growth and wealth preservation, making it accessible for everyday investors to adopt these proven methods and achieve long-term financial security․

Avoiding Stock Market Speculation

Billionaires often steer clear of stock market speculation, focusing instead on stable, long-term investments․ The guide underscores the risks of short-term trading and market timing, which can lead to significant losses․ By avoiding speculative investments, individuals can safeguard their wealth and achieve consistent growth․ The guide advocates for a disciplined approach, emphasizing asset diversification and strategic planning over market gambling․ This method aligns with the strategies of wealthy families like the Vanderbilts, who prioritized sustainable wealth management․ By following these principles, everyday investors can reduce financial risk and build a secure future, shielding their assets from market volatility and ensuring generational prosperity․

Case Studies of Billionaire Success

The Rockefeller legacy and Vanderbilt family fortune illustrate how strategic planning and disciplined financial practices create lasting wealth․ These case studies highlight the importance of avoiding short-term gains for long-term prosperity, showcasing billionaire strategies that everyday investors can emulate․

The Rockefeller Legacy

The Rockefeller family exemplifies generational wealth creation․ They built a vast fortune through strategic investments in industries like oil and banking, emphasizing long-term planning and risk mitigation․ By establishing a family bank, they centralized financial decisions, ensuring wealth preservation and growth․ Their approach avoided market speculation, focusing instead on stable, high-yield assets․ The Rockefellers also prioritized financial education, ensuring each generation understood wealth management․ Their legacy highlights the importance of disciplined strategies and shared financial goals․ This case study offers valuable insights for everyday investors aiming to replicate billionaire success, showing how patience and prudent planning can lead to lasting prosperity․ Their story is a cornerstone of “What Would Billionaires Do?” guiding readers toward similar achievements․

The Vanderbilt Family Fortune

The Vanderbilt family once represented one of America’s wealthiest dynasties, built by Cornelius “Commodore” Vanderbilt through strategic investments in shipping and railroads․ However, their fortune declined significantly due to poor financial decisions and lavish spending by later generations․ William Henry Vanderbilt briefly doubled the family’s wealth but struggled with maintaining growth․ The Vanderbilts became known for their extravagant lifestyle, which ultimately led to financial mismanagement․ Their story serves as a cautionary tale about the importance of disciplined wealth management and avoiding reckless spending․ The Vanderbilt legacy underscores the challenges of preserving generational wealth without proper financial education and strategic planning․ This case study in “What Would Billionaires Do?” highlights the contrasting outcomes of smart investments versus uncontrolled expenditure, offering valuable lessons for modern investors․ Their rise and fall illustrate the fragility of wealth without a sustainable approach․

Practical Steps for Everyday Investors

Start by prioritizing financial education and strategic planning․ Utilize free resources like the “What Would Billionaires Do?” PDF to learn proven wealth-building strategies․ Focus on minimizing risk through diversified investments and avoiding speculative markets to ensure long-term financial stability and growth․

How to Start Implementing Billionaire Strategies

To begin implementing billionaire-inspired strategies, start by educating yourself using resources like the What Would Billionaires Do? free PDF guide․ This guide outlines proven methods for wealth creation and preservation, such as minimizing risk and taxation․ Begin by assessing your financial situation and setting clear, long-term goals․ Consider creating a “family bank” to centralize and manage wealth effectively․ Diversify investments across asset classes, focusing on stable, income-generating opportunities rather than speculative ventures․ Leverage tax-advantaged accounts and seek professional advice to optimize your financial plan․ Additionally, adopt a disciplined approach to spending and investing, avoiding lifestyle inflation․ By following these steps, you can align your financial decisions with the strategies used by billionaires to build and sustain generational wealth․

Resources for Free Downloads and Guides

Accessing the “What Would Billionaires Do?” guide is straightforward, with free PDF downloads available online․ Platforms like Open Library and Wealth Factory offer the guide in various formats, including PDF, text, and audiobook․ Additionally, purchasing the Best Value option provides bonuses such as hardcover books and instant audiobook downloads․ The guide outlines strategies for generational wealth, emphasizing financial education and risk reduction․ It also includes practical steps for implementing billionaire-inspired investment approaches․ With these resources, readers can gain insights into creating a family bank, diversifying assets, and avoiding stock market speculation․ The free downloads make it accessible for anyone to start their journey toward financial independence and wealth preservation․ These resources are designed to empower individuals with the knowledge and tools needed to secure their financial future․